Share this post :

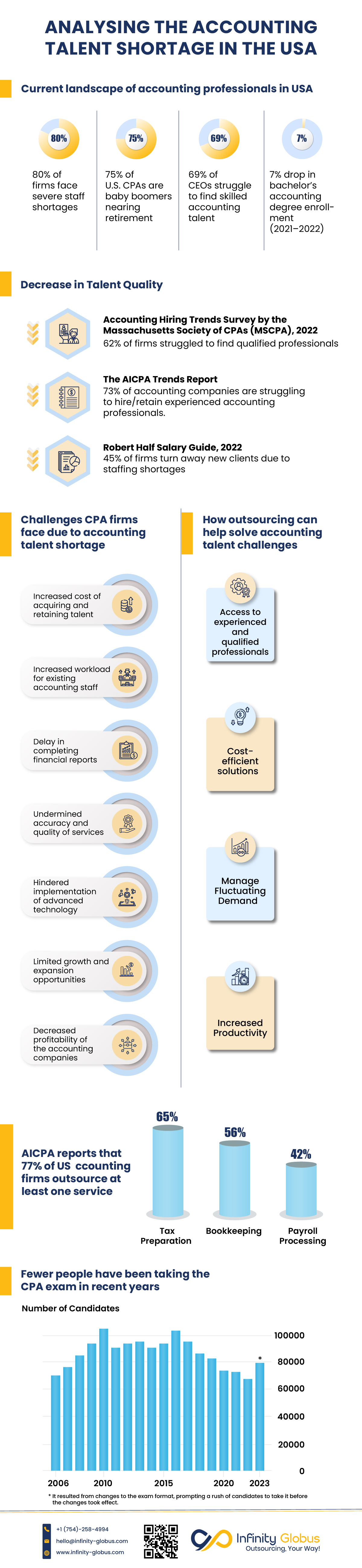

In the accounting landscape, it’s not a hidden fact that there are fewer accounting professionals, leading to a high accounting talent drought in the USA these days. From the statistical analysis of the current market of accounting professionals in the USA, we have a clear picture of the severity of this issue. The observations show that 80% of accounting firms are facing severe staff shortages, with 75% of practicing CPAs near their retirement age and around 69% of Chief Financial Officers (CFOs) struggling to find qualified professionals for accounting. Furthermore, there has been a concerning 7.8% decline in enrolled candidates at the bachelor’s level between 2021 and 2022.

Moreover, many authorized organizations have released data showing that along with the accounting talent shortage, there has been a significant decrease in talent quality as well. Furthermore, fewer people have been taking the CPA exam in recent years, which is also a primary reason for the scarcity of accountants.

The accounting talent shortage has posed significant challenges for CPA firms in conducting operations across the USA. They are struggling with significant challenges such as increased costs, increased workload, delayed financial reporting, compromised service quality, obstructed technology implementation, stagnant growth and decreased profitability.

To keep up with challenges imposed by accounting talent shortage, CPA firms can opt for outsourcing solutions that effectively deal with and solve accounting talent shortages and associated challenges. Further, it was observed by the American Institute of CPAs that around 77% of accounting firms in the USA have outsourced at least one service.

By leveraging outsourcing, firms can access experienced and qualified professionals, facilitate cost-efficient solutions, help manage fluctuating demand, increase productivity and overcome challenges imposed by accounting talent shortage.